An SR-22 is a certificate of financial responsibility required by Arizona that proves you have the required car insurance. It’s usually required after a major violation or license suspension.

An SR-22 is proof of financial responsibility that is required by the court and is a form filed by your insurance company. An SR-22 form is usually needed after your driver’s license has been suspended or revoked or after a major violation. It proves that you have Arizona-mandated liability insurance.

When you need an SR-22, your car insurance rates will increase by an average of 57% a year in Arizona. The reason for the increase isn’t that you need an SR-22; rather, it’s due to the violation that resulted in the SR-22 requirement.

For example, if you’ve been convicted of a DUI and need an SR-22 certificate to reinstate your license, your rates will go up. But they’ll go up because you have a DUI on your record, not because you need an SR-22. The SR-22 filing is one of the requirements for getting your license back; the insurance rate increases are due to the DUI.

What is SR-22 insurance?

An SR-22 is a certificate of financial responsibility mandated by Arizona to prove you have the required minimum car insurance. SR-22 insurance is not a specific type of car insurance; your policy remains the same in terms of coverage.

The term SR-22 insurance is commonly used to describe any policy where the insurance company has to file an SR-22 for the insured driver. The insurance company will file the form with the state and will also report any lapse in your coverage. An SR-22 usually requires that you carry Arizona-mandated minimum liability coverage levels, but you can add any additional coverage you want, including comprehensive and collision.

How much does SR-22 insurance cost?

The cost of an SR-22 filing is a one-time filing fee. The standard SR-22 filing fee is $25, but it can be higher. That doesn’t affect your car insurance rates.

However, the violation that resulted in an SR-22 requirement will lead to higher rates. In short, it’s your violation of the law and not the SR-22 that will hike up your rates, so the rate increase depends on what that violation was.

For example, with a DUI in Arizona, if the average rate is $1,719 the DUI rate would be $2,693 an increase of $974 or 57%, according to the most recent rate analysis by Insurance.com.

How much SR-22 insurance costs a month is simply a division of the annual rate into 12 payments. However, you may be required to pay the full amount up front when your car insurance policy includes an SR-22

What is non-owner car insurance with an SR-22?

If you don’t own a car but are required to carry an SR-22, non-owner car insurance is an option to fulfill your SR-22 filing requirements.

A non-owner policy insures you as the driver when you are behind the wheel of a car owned by someone else. Since you can’t get a regular car insurance policy if you don’t own a car, a non-owner policy allows you to get the required coverage and get your SR-22 filed with the state.

What happens to an SR-22 if you move to another state?

Not every state uses an SR-22 certificate of financial responsibility. These are the states that don’t use the SR-22:

- Delaware

- Kentucky

- Minnesota

- New Mexico

- New York

- North Carolina

- Oklahoma

- Pennsylvania

If you have an SR-22 in one state and move to another state, you’ll typically still be required to keep an SR-22 on file in your previous home state. You’ll need to look for an out-of-state SR-22 filing from a nationwide auto insurance carrier.

How your SR-22 is handled will depend on the state. Some states will waive the requirement, while others will require you to file a new SR-22. Speak to your insurance company and to the DMV to find out what you need to do.

Which insurance companies offer SR-22 filings?

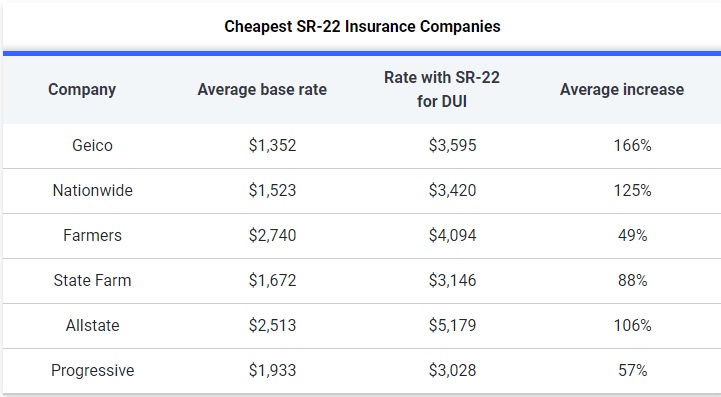

Most car insurance companies can and will file an SR-22 form for you, including some of the best-known insurers. All of the companies in the table below will file an SR-22.

You can see that the rate increase varies. For example, you could pay 166% more for a Geico SR-22 policy than for standard car insurance without the SR-22 requirement.

Methodology

Insurance.com commissioned rate data from Quadrant Data Services based on a 40-year-old male driver with a 2021 Honda Accord LX. Rate data was collected in 2022 from multiple companies and ZIP codes in every state.