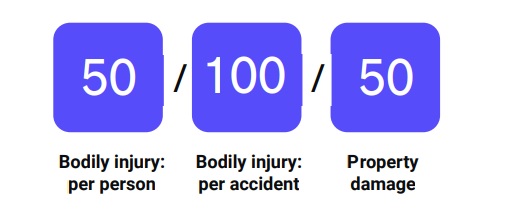

What do these numbers on your policy mean?

These numbers represent the dollar limits of how much your insurer will pay to cover injury and property damage costs if you are involved in an accident. Each state has minimum liability requirements, but drivers may buy more coverage for extra protection. In Arizona this includes golf carts, motorcycles and mopeds.

Minimum levels of financial responsibility in Arizona are:

- $25,000 bodily injury liability for one person and $50,000 for two or more persons

- $15,000 property damage liability

For example, 50/100/50 means you have coverage up to $50,000 for each person injured in an accident you cause, up to $100,000 for all people injured in the accident, and up to $50,000 for property damage. If you cause damage that exceeds these limits, you’re on your own to cover the rest.

Liability coverage pays for injuries and property damage suffered by others when you’re at fault in an accident. This coverage is legally required for drivers everywhere in the U.S. (except New Hampshire) – but note that liability does not cover your own vehicle damage or injuries.

Collision coverage pays for damage to your vehicle if it hits another car or inanimate object, whether its a minor fender-bender or major highway pileup.

Comprehensive coverage damage to your vehicle in unexpected scenarios that aren’t accidents with other cars. This includes (but is not limited to)

weather damage and theft. You may also see this written as “other than collision” coverage.

Full coverage typically means that you have comprehensive and collision coverage combined.