To bundle or not to bundle?

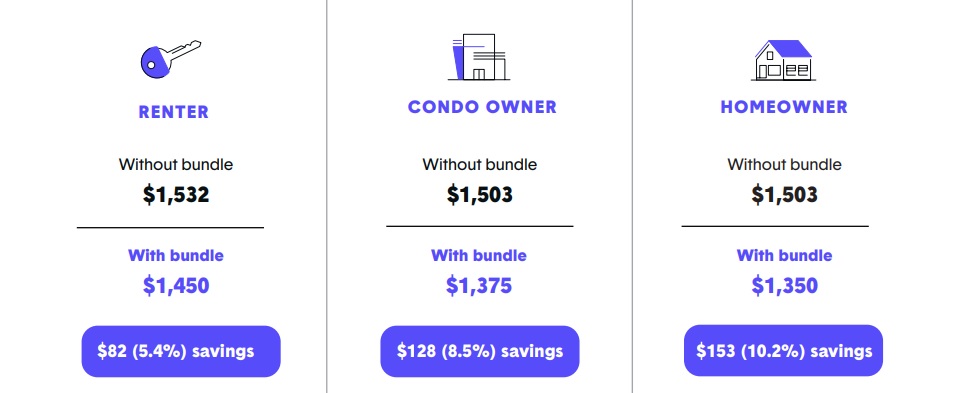

Many purchase three or more types of insurance coverage from the same company — commonly known as bundling. When you bundle coverage for your apartment, house, or condo with coverage for your car, motorcycle, or boat you can save 5 – 10% on car insurance. The amount of savings can change depending on the insurance company and other insured properties.

If you have decided to bundle your car and home insurance, you may save on premiums—at least at first. These savings happens because bundling, by design, only works when you avoid shopping around. Bundling also makes you less likely to shop around or switch providers to get a better price. Again, this is good for the company but not so good for you. The company is more likely to keep your business, even if it no longer offers the best rates. Some companies strive to build loyalty, which means you’ll continue to receive a discount. Other companies will continue to offer you a “discount” but slowly raise the cost of your plans.

You might be able to get the multi-policy discount on a policy in advance. For example, if you switch your auto insurance to a new carrier but want to switch your home policy when it renews, let your new carrier know. As long as you commit, you might get a discount before the switch even happen

Source: thezebra.com