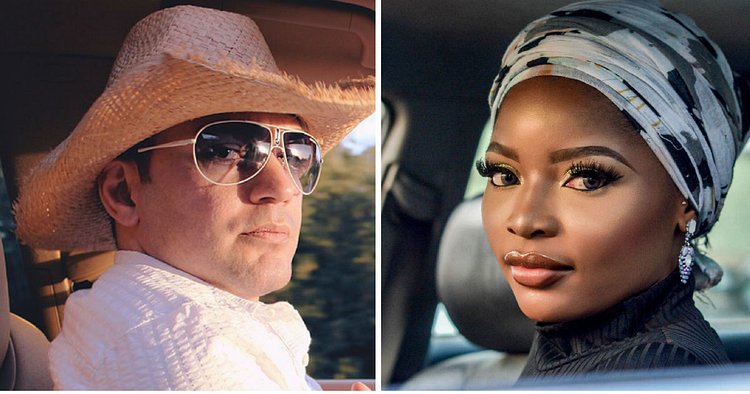

Is Gender Still Relevant in Car Insurance Pricing?

While 45 states still allow price differences between men’s and women’s car insurance, the practice has become increasingly controversial.

Who’s for it?

Car insurance companies have generally argued in favor of keeping gender as a rating factor because, they say, it helps them more accurately price risk.

Insurers consider gender in combination with many other risk factors (like what kind of car you drive and your years of driving experience) when pricing insurance.When states prohibit rating factors like gender, it doesn’t mean the extra cost insurers charge certain groups disappears. It just gets distributed in a different way.

In California, for example, Department of Insurance analysis shows that eliminating gender could give the riskiest group — young male drivers with fewer than three years of driving experience — a 5 percent break on their insurance costs while less-risky young female drivers could end up paying more.

Who’s against it?

Consumer advocates, however, have become increasingly vocal about the cost disparities highlighted in this report and by previous consumer studies. They argue that if gender were strongly tied to how likely men and women are to file a claim, we’d see more consistency across insurers and locations. They say that wildly varying rates are unfair, and that it’s time for men and women to just pay the same.

Consumers concerned about the impact of their gender on their car insurance costs can shop around for an insurance company that doesn’t consider gender when setting rates — or one that rates their gender more favorably.

Industry trade groups have disputed previous consumer studies showing that women are charged more than men, but they have not shared alternate data or explained why female drivers may see higher prices in some states.