In defensive driving class most drivers know that a moving violation, such as a traffic ticket, will cause an auto insurance rate hike.

In defensive driving class most drivers know that a moving violation, such as a traffic ticket, will cause an auto insurance rate hike.

However, the size of that rate increase may be a little shocking to some.

We share this document with students in defensive driving class that shows that for the second year in a row, auto insurance premiums can climb by as much as 92 percent after a single moving violation on average nationwide.

The study, done by insurance quotes.com, analyzed the average national premium increase for one moving violation in 17 categories.

The study found that premium increases vary significantly between different types of violations.

For instance, one conviction for driving under the influence (DUI), also known as driving while intoxicated or DWI, will result in a national average premium increase of 92 percent; however, driving without a license results in a 16 percent average premium spike

According to Mike Barry, spokesman for the nonprofit Insurance Information Institute (III), this study further illustrates the ways in which insurers use various driving infractions as a way to assess different levels of risk for individual drivers.

“The bottom line is that certain moving violations are linked to more expensive claims than others,” Barry says. “I’m not surprised at all by the DUI number because an incident like that has the potential for a truly catastrophic loss of life, bodily injury and even very expensive lawsuits.”

How much insurance rates rise after a moving violation

According to the study, some moving violations will impact your insurance rates very little, while others will result in a significant spike.

These findings should come as no surprise, says Dan Weedin, a Seattle-based insurance and risk management consultant.

“The more a driver is willing to thumb his or her nose at the law and the safety of others, the more the premium increase is going to hurt, because insurance companies don’t care for that behavior,” Weedin says.

For instance, Weedin points out that most drivers know that speeding 30 miles per hour over the speed limit is more severe — and dangerous — than exceeding the limit by 5 mph.

What’s more, insurance companies have algorithms that show certain driving behaviors to be more indicative of future risk than others.

“The likelihood of someone being in an at-fault accident is higher after a reckless driving violation compared to someone who gets pulled over for driving without a license,” Weedin says. “Insurance companies will start charging you more based on how risky you are to insure.”

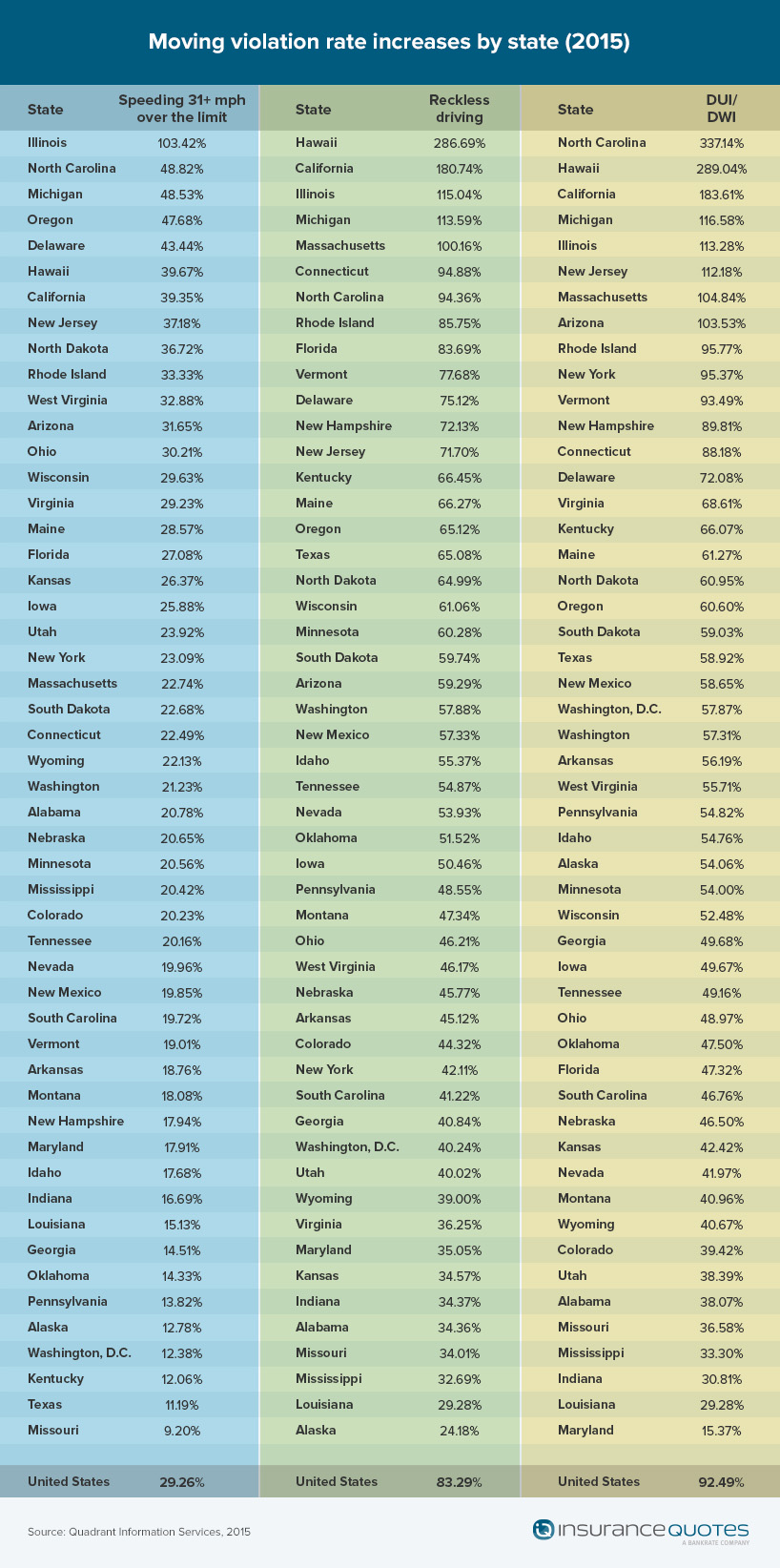

How moving violations affect insurance rates by state

The type of moving violation isn’t the only thing that may affect your auto insurance rate. The state where you live also affects how much a moving violation will impact your rate.

- For instance, a DUI conviction in North Carolina will result in an average premium increase of337 percent(in Hawaii it’s 289 percent, and 184 percent in California). Meanwhile, the same violation in Maryland will only result in an average premium increase of 15 percent.

- Similarly, a reckless driving violation in Hawaii will result in an average premium increase of287 percent (181 percent in California), while in Arkansas the same violation will only bring about an average premium increase of 24 percent.

According to Doug Heller, an independent consumer advocate with the Consumer Federation of America, this state-by-state disparity boils down to how each state uniquely regulates auto insurers.

“Insurers in some states can use a whole host of rating factors that aren’t in any way related to how someone drives,” Heller says. “But other states are much more prohibitive on how they can set rates, which is probably the source of the divide.”

In California, for instance, an individual’s driving safety record must be the primary factor in determining what he or she will pay for insurance (the same goes for Hawaii).

This means that any blemishes on your driving record — such as a DUI or reckless driving violation — will impact your premium more significantly than in less tightly regulated states. If you do get an Arizona traffic ticket take our defensive driving class. 2passdd.com