AUTO INSURANCE RATES BY LENGTH OF

CONTINUOUS COVERAGE

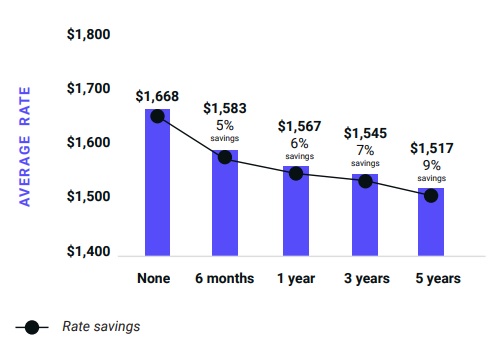

Maintaining continuous automobile insurance coverage without any lapses (even for a day!) is important because insurance companies view drivers who

are already insured as very financially responsible and therefore a much lower risk. Notably, California is the only state where insurance companies don’t

take insurance history into consideration when setting rates.

HOW MUCH DO DRIVERS SAVE BY

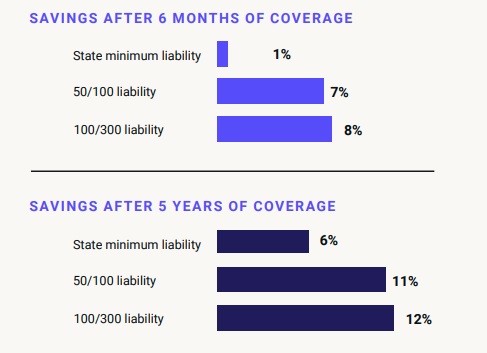

MAINTAINING DIFFERENT COVERAGE LEVELS?

A driver’s prior level of automobile insurance coverage also factors into future rates. Drivers who maintain high levels of liability coverage see significant

savings over time. For example, a driver who maintains state minimum coverage for five years would save about 6% on insurance compared to

someone without a coverage history. A driver who maintained 100/300 liability coverage for five years would save 12%.